How Are Crypto Gifts Taxed in the USA?

Thinking of sending Bitcoin to a friend or family member? Or maybe you've received cryptocurrency as a gift and you're wondering how it affects your taxes. In this guide, we'll walk you through everything you need to know about crypto gift taxes, from reporting requirements to calculating your tax liability.

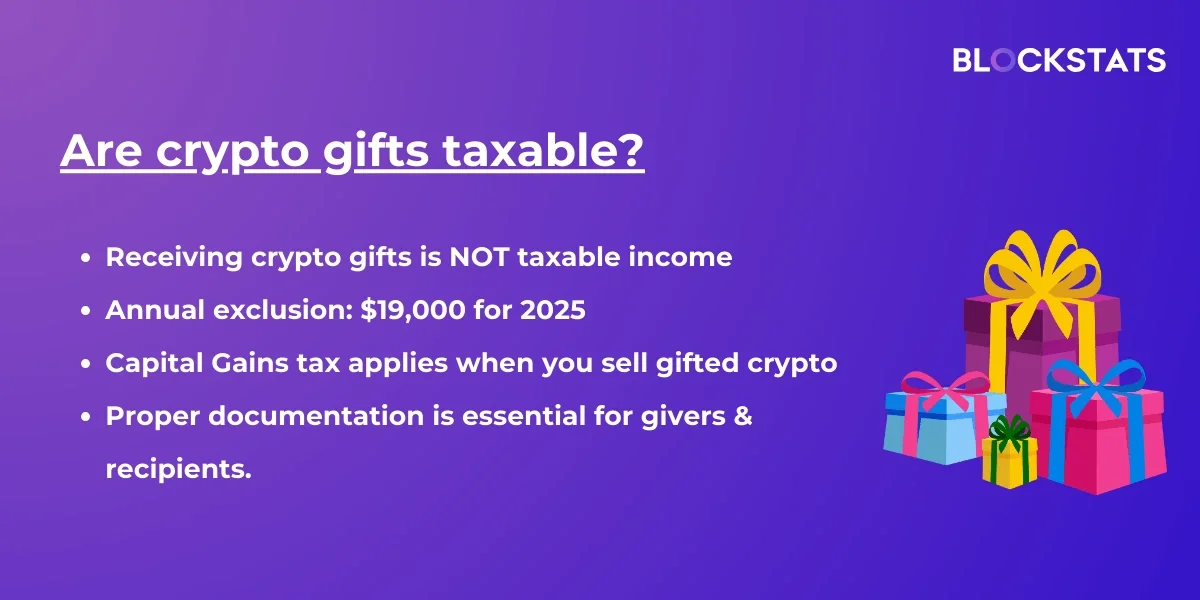

Key takeaways

For 2024, you can gift up to $18,000 per person without reporting the gift. This limit is set to rise to $19,000 for the 2025 tax year.

Receiving a crypto gift is not taxable income

You'll owe capital gains tax when you sell or dispose of gifted cryptocurrency

Your cost basis depends on whether the crypto increased or decreased in value

Proper documentation is essential for both givers and recipients

What are cryptocurrency gifts?

In the eyes of the IRS, a gift is a transfer of property where you receive nothing, or less than full value, in return. This could be sending Bitcoin to your daughter for her birthday, giving Ethereum to a friend, or transferring any other cryptocurrency to someone as a present. If you're trading crypto for goods, services, or other assets, that's not a gift, it's a taxable transaction.

You can gift Bitcoin, Ethereum, stablecoins, memecoins, or NFTs. And just like other types of gifts, the IRS has specific rules around when the gift must be reported and how taxes apply. If you’re giving or receiving crypto as a gift, understanding these rules can help you avoid mistakes and prevent unexpected tax bills down the road.

Crypto gift tax US

The United States has specific rules governing how cryptocurrency gifts are taxed. For the 2025 tax year, you can give up to $19,000 worth of crypto to any one person without triggering gift tax reporting requirements. (For 2024, it was $18,000). This amount is known as the annual gift tax exclusion.

If you exceed this threshold, you'll need to file IRS Form 709. However, filing this form doesn't necessarily mean you'll owe taxes. The US also provides a lifetime gift tax exemption of $13.99 million for 2025. As long as your total lifetime gifts don't exceed this amount, you won't actually pay gift tax.

Read next: How to calculate crypto tax in U.S.

Are you taxed when you gift crypto?

No, giving cryptocurrency as a gift is not a taxable event for you. You won't recognize capital gains or losses simply by transferring your crypto to someone else.

However, you do need to be aware of the reporting requirements. If the fair market value of your crypto gifts to any single person exceeds $19,000 in a calendar year, you must file Form 709. This applies even if you make multiple smaller gifts throughout the year that add up to more than $19,000.

Keep in mind that gifts between spouses are unlimited and don't require filing Form 709. You can give your spouse cryptocurrency of any value without tax implications.

Unfortunately, Form 709 cannot be filed electronically. You'll need to print it out and mail it to the IRS. The deadline is April 15 of the following year, though you can extend this to October 15 if you file for a tax extension.

What information do I need to prove that I've given a crypto gift?

Documentation is crucial when gifting cryptocurrency. We recommend creating a record that includes:

-

The names of both the gift giver and the recipient

-

A detailed description of the cryptocurrency being gifted, including the name and amount

-

Your original date of acquisition for the cryptocurrency

-

Your adjusted cost basis for the cryptocurrency

-

The date you transferred the gift

-

The fair market value of the crypto at the time of transfer

-

A clear statement that this transfer is a gift with no expectation of repayment

This documentation helps the recipient calculate their taxes accurately when they eventually sell or dispose of the cryptocurrency. It can also protect both parties in case of an IRS audit.

Are you taxed on receiving crypto gifts?

Tax on receiving a crypto gift

Receiving cryptocurrency as a gift is not a taxable event. You don't need to report the gift as income on your tax return.

This is true regardless of the value of the gift. Whether you receive $100 or $100,000 worth of Bitcoin, you won't owe taxes at the time you receive it.

Tax on selling crypto gifts you received

While receiving a crypto gift isn't taxable, selling it is. When you dispose of gifted cryptocurrency, you'll need to calculate your capital gains or losses using this formula:

Capital Gain/Loss = Sale Price - Cost Basis

The tricky part is determining your cost basis, which depends on how the cryptocurrency's value has changed since the original owner acquired it.

How much you owe depends on:

Your tax liability when selling gifted crypto depends on three key factors:

-

The gift giver's original cost basis

-

The fair market value when you received the gift

-

The sale price when you dispose of the crypto

These three values determine which cost basis rules apply to your situation.

Example

Let's walk through a detailed scenario to illustrate how this works.

Scenario: Sarah buys 1 Bitcoin for $30,000 in January 2023. In March 2024, when Bitcoin is worth $25,000, she gifts it to her son Michael. In November 2025, Michael sells the Bitcoin for $40,000.

Since the sale price ($40,000) is higher than Sarah's original cost basis ($30,000), Michael uses Sarah's cost basis to calculate his taxes.

Michael's capital gain: $40,000 - $30,000 = $10,000

Michael will owe capital gains tax on this $10,000 gain. If he held the Bitcoin for more than one year from when Sarah originally acquired it, he'll qualify for long-term capital gains rates.

Tax on crypto gifts when the price increases

If the value of your gifted cryptocurrency has increased since you received it, your cost basis depends on whether the current price is above or below the gift giver's original cost basis.

If the price is higher than the giver's cost basis: You use the giver's original cost basis to calculate your gains. This is the most straightforward scenario.

If the price is higher than when you received it but lower than the giver's cost basis: You may not have any taxable gain or loss. In this "no man's land" scenario, your sale price falls between the giver's cost basis and the fair market value at the time of the gift, resulting in zero capital gain or loss.

What records to keep

As a gift recipient, you should maintain detailed records, including:

-

The date you received the cryptocurrency

-

The fair market value at the time you received it

-

The gift giver's original cost basis

-

The gift giver's original acquisition date

-

Any documentation provided by the gift giver

-

Records of when you eventually sell or dispose of the crypto

These records are essential for accurately calculating your taxes and defending your position in case of an audit.

What are the common mistakes to avoid when gifting or receiving crypto as a gift?

Many cryptocurrency users make avoidable errors when handling crypto gifts. Here are the most common pitfalls:

Not documenting the transfer properly: Without written records, recipients may struggle to determine their correct cost basis, potentially leading to overpayment or underpayment of taxes.

Assuming all transfers are gifts: If there's any expectation of repayment or if the transfer is compensation for services, it's not a gift. These transactions have different tax implications.

Forgetting to file Form 709: Even if you don't owe gift tax, failing to file this form when required can result in penalties.

Using the wrong cost basis: Gift recipients often mistakenly use the fair market value at the time they received the gift as their cost basis, which can lead to incorrect tax calculations.

Not considering the gift giver's holding period: For long-term capital gains treatment, you inherit the gift giver's holding period. If they held the crypto for more than a year, you qualify for long-term rates even if you sell immediately.

Gifting crypto that has declined in value: If you own cryptocurrency that's worth less than what you paid, it's usually better to sell it first (to claim the capital loss) and then gift the cash proceeds.

Need to estimate what you'll owe before diving into taxes? Check Blockstats' crypto tax calculator to get a quick preview of your tax liability based on your crypto activities like gifting, trading staking.

Calculate crypto gift taxes with Blockstats

Tracking cryptocurrency gifts and calculating your taxes can be complicated, especially if you've made or received multiple gifts throughout the year.

Blockstats simplifies the entire process. Our crypto tax software automatically tracks your transactions, determines the correct cost basis for gifted cryptocurrency, and generates comprehensive tax reports that are ready to file.

Whether you're giving crypto to loved ones or receiving digital assets as gifts, Blockstats ensures you stay compliant while maximizing your tax efficiency. Join thousands of crypto investors who trust Blockstats to handle their cryptocurrency tax reporting.

Get started with Blockstats today and take the stress out of crypto tax season.

Frequently asked questions

Can the IRS track crypto gifting?

Yes, the IRS can track cryptocurrency gifts. While blockchain transactions are pseudonymous, exchanges and wallets are required to report certain transactions to the IRS. The IRS has significantly increased its crypto enforcement efforts in recent years, so it's essential to properly report all taxable events and required forms.

How much crypto can you gift tax-free?

For 2025, you can gift up to $19,000 worth of cryptocurrency to any single person without needing to file a gift tax return. Even if you exceed this annual exclusion, you likely won't owe actual gift tax unless your lifetime gifts exceed $13.99 million for 2025.

How to gift crypto to avoid taxes

You cannot completely avoid taxes when gifting cryptocurrency, but you can minimize tax implications. Staying under the annual $19,000 limit or using spousal transfers. Also, by donating appreciated crypto to qualified charities

Do you pay tax on crypto coins when you receive a gift?

No, receiving cryptocurrency as a gift is not taxable. You don't report it as income, and you don't owe taxes at the time you receive it. However, you will owe capital gains tax when you eventually sell or dispose of the gifted cryptocurrency.

How do I prove that the crypto I received was a gift?

The best proof is documentation from the giver, specifically, a signed statement or digital equivalent that confirms the transfer was a gift, along with the giver’s original cost basis and the FMV on the date of the transfer.

Can foreign parents or others gift crypto tax-free?

Yes, foreign individuals can gift cryptocurrency to US recipients. However, special reporting rules apply. If you receive gifts from foreign persons totaling more than $100,000 in a year, you must report these on Form 3520.

Can crypto gifts reduce my tax bill?

Crypto gifts themselves don't directly reduce your tax bill. However, there are strategic ways to use gifting, like gifting crypto to family members in lower tax brackets. Also, donating cryptocurrency to qualified charities can reduce tax liability.